Operational & Cyber Risk, Business Continuity & Third-Party Risk Management

APRA CPS230: Operational Risk Management

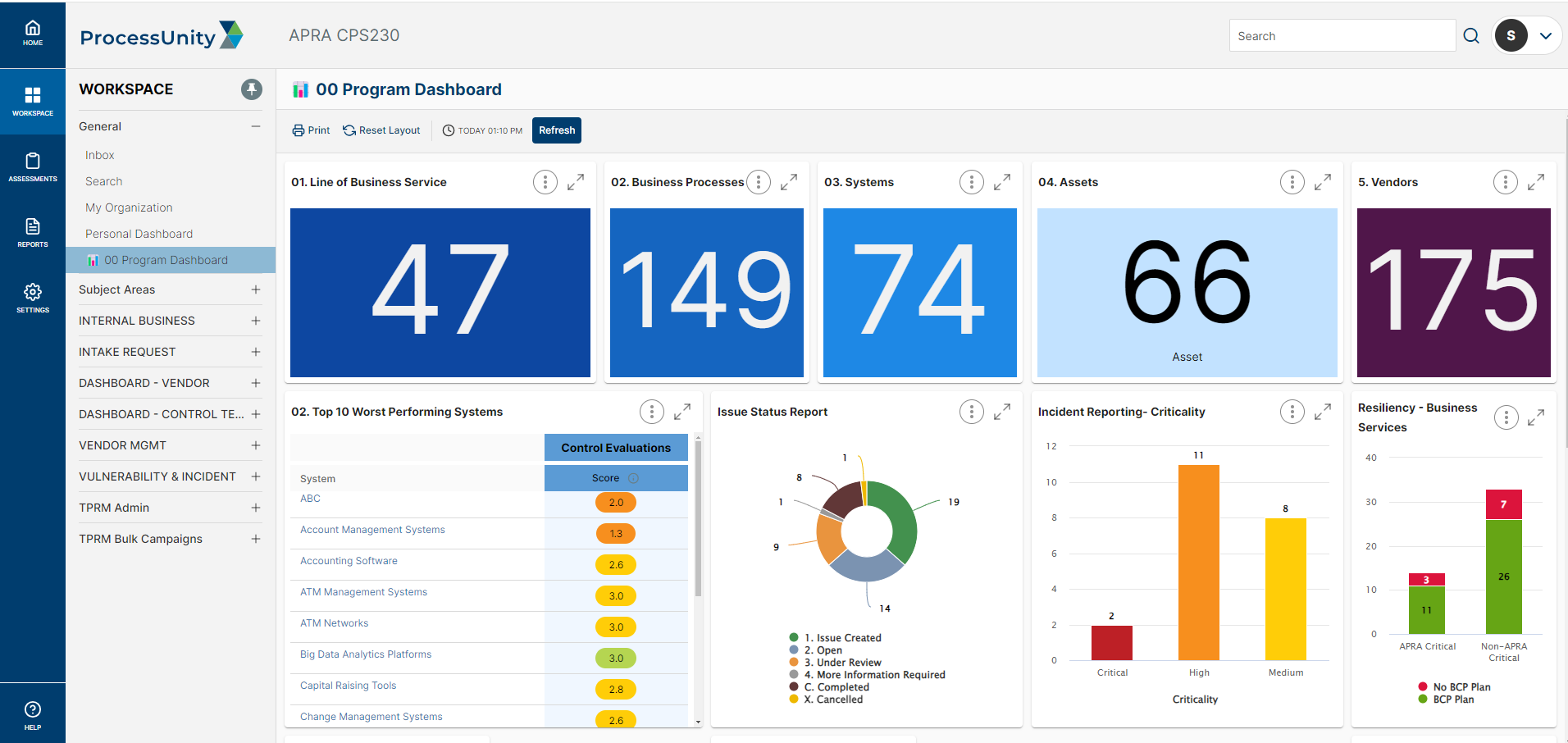

For APRA CPS230: Operational Risk Management compliance, ProcessUnity provides a turnkey solution to create a resilient operational risk posture both internally and externally, enabling you to establish:

- A risk management framework to identify, assess, and manage operational and cyber risks with effective internal controls, monitoring, and remediation;

- A credible business continuity plan, maintaining oversight of your third parties to ensure they can continue delivering critical operations within tolerance levels during severe disruptions

- An effective management strategy for risks associated with your third parties, including a comprehensive service provider management policy, formal agreements, and robust monitoring.

The focus of APRA CPS230 is to elevate operational resilience standards. APRA-regulated entities have until mid-2025 to comply with the new standard’s requirements, CPS 230. This standard will help entities understand and manage risks across their operational value chain, particularly those associated with providing essential services to customers.

In addition to taking preventative measures, entities regulated under CPS 230 must implement procedures to continuously assess and treat operational resilience, report and respond to incidents as they occur, and adjust in the aftermath of an incident to reduce the likelihood and impact of similar events in the future. For organizations impacted by CPS 230, it is not enough to know how to stop an incident; they must also understand how to control the impact after it occurs.

To protect your organization from the increasing threat of operational incidents and to achieve compliance in time to avoid APRA penalties, it is essential to understand the facets of risk management regulated by CPS 230 and the tools available for meeting the regulation’s demands.

Key Benefits: Processunity for APRA CPS 230

-

Accelerated APRA CPS230 Compliance:

A comprehensive solution that meets complex requirements across the enterprise, with the ability to integrate with existing processes via API.

-

Simplified Executive Reporting and Notification:

Provides executive reporting, operational resiliency thresholds, and notification requirements, offering clear visibility and reducing the effort needed for reporting and notifications.

-

Value Chain Visibility:

Enables visibility across the entire value chain, linking lines of business, business processes, systems/applications, and vendors.

-

Automated Workflow Processes:

Facilitates workflow processes to conduct operational risk assessments for internal systems and due diligence on third parties.

-

Multi-Risk and Threat Intelligence:

Utilizes data partners for multi-risk domain and threat intelligence capabilities. Leverages the GRX exchange to enhance speed and scalability in managing third- and fourth-party concentration risk.

-

Operational Risk Identification:

Identifies operational risk disruptions and assesses their impact on associated processes or customer-facing applications.

-

Collaboration and Compliance:

Supports collaboration across different functions and demonstrates compliance to auditors and regulators.

ProcessUnity combines its offerings into one comprehensive solution designed to help you meet APRA CPS230 obligations. The table below outlines the core APRA CPS230 components and how ProcessUnity streamlines your adherence to these requirements.

| Key Requirement | Detail | ProcessUnity Solution Component |

| Operational Value Chain and Board Reporting |

|

|

| Operational Risk Management Framework |

|

|

| Business Continuity Plans and Resiliency Thresholds |

|

|

| Service Provider Arrangements |

|

|

| Vulnerabilities Operational risk incidents |

|

|

WHO APRA Applies to

This Prudential Standard applies to all APRA-regulated entities defined as:

- Authorised deposit-taking institutions (ADIs), including foreign ADIs, and non-operating holding companies authorised under the Banking Act (authorised banking NOHCs);

- General insurers, including Category C insurers, non-operating holding companies authorised under the Insurance Act (authorised insurance NOHCs), and parent entities of Level 2 insurance groups;

- Life companies, including friendly societies, eligible foreign life insurance companies (EFLICs), and non-operating holding companies registered under the Life Insurance Act (registered life NOHCs);

- Private health insurers registered under the PHIPS Act; and

- Registrable superannuation entity licensees (RSE licensees) under the SIS Act in respect of their business operations.

The obligations imposed by this Prudential Standard on, or in relation to, a foreign ADI, a Category C insurer, and an EFLIC apply only to the Australian branch operations of that entity.

Where an APRA-regulated entity is the Head of a group, it must comply with a requirement of this Prudential Standard:

- In its capacity as an APRA-regulated entity.

- By ensuring that the requirement is applied appropriately throughout the group, including in relation to entities that are not APRA-regulated, and

- On a group basis.

ProcessUnity for APRA CPS230 streamlines your adherence to new regulatory requirements. Schedule a call today to learn how ProcessUnity can help you meet your compliance obligations. We can assist with the entire compliance process or specific areas of the requirement. Leverage the flexibility of our offering to meet your unique compliance needs, whether internal control testing, business continuity, third-party risk management, incident management, or reporting.

Request a Demo: ProcessUnity's APRA CPS230 Operational Risk Management Software

ProcessUnity’s Third-Party Risk Management platform creates a resilient operational risk posture for APRA CPS230 compliance.

Request a Demo: ProcessUnity's APRA CPS230 Operational Risk Management Software

Frequently Asked Questions

APRA CPS230 is a cybersecurity standard issued by the Australian Prudential Regulation Authority (APRA). It mandates regulated entities to implement a robust operational risk management framework that ensures resilience against operational disruptions.

APRA compliance involves adhering to regulatory requirements set by the Australian Prudential Regulation Authority, including:

- Managing operational risk

- Maintaining business continuity

- Overseeing third-party service providers

Standards like CPS230 define the expectations for risk governance across Australia’s financial services sector.

Operational risk management software streamlines CPS230 compliance by automating:

- Risk assessments

- Third-party monitoring

- Incident reporting

- Executive-level reporting

These capabilities increase visibility and control across the operational value chain to accelerate APRA compliance.

No, APRA compliance won’t disrupt current operations. ProcessUnity’s solution is built to align with your existing governance and risk frameworks. It enhances operational resilience through streamlined workflows and well-defined governance — without interfering with daily business activities.

No. APRA compliance is required only for APRA-regulated entities such as:

- Banks

- Insurers

- Superannuation licensees

- Other financial institutions operating in Australia

- Financial institutions outside Australia that serve APRA-regulated entities