Keep Pace with the Evolving Regulatory Landscape for TPRM

Global regulators continue to introduce and evolve legislation related to Third-Party Risk Management, adding to the complexity of due diligence and risk assessments. Maintaining compliance requires your team to constantly monitor and adapt to each regulation, which is resource-intensive and requires robust internal processes and systems.

ProcessUnity Accelerators Ensure Compliance

With purpose-built accelerators for global Third-Party Risk Management regulations, ProcessUnity’s TPRM Platform empowers your team to systematically evaluate and manage the risks associated with your supplier relationships to ensure compliance, security and ethical business operations. Our comprehensive platform offers tools for continuous monitoring, reporting, and managing third-party relationships so you can effectively meet your regulatory requirements and adapt to changes while minimizing risks associated with your business partners.

Whitepaper

DORA: Key Provisions and Best Practices

Whitepaper

Build an Effective ABAC Program

Robust Support for DORA, APRA, ABAC, and LkSG

DORA, APRA, ABAC, and LkSG each emphasize the importance of managing risks associated with external partners, suppliers, and service providers. ProcessUnity offers regulation-specific support for the most critical regulations, frameworks, and standards including:

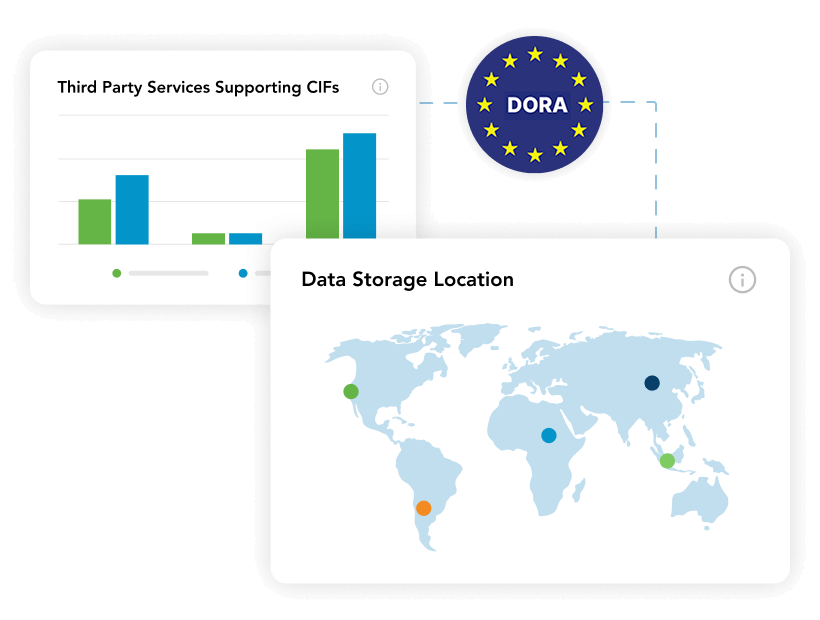

DORA (Digital Operational Resilience Act)

DORA requires financial institutions in the European Union to manage risks associated with third-party ICT service providers. This includes ensuring that these providers have robust security measures and resilience plans in place to prevent and respond to disruptions.

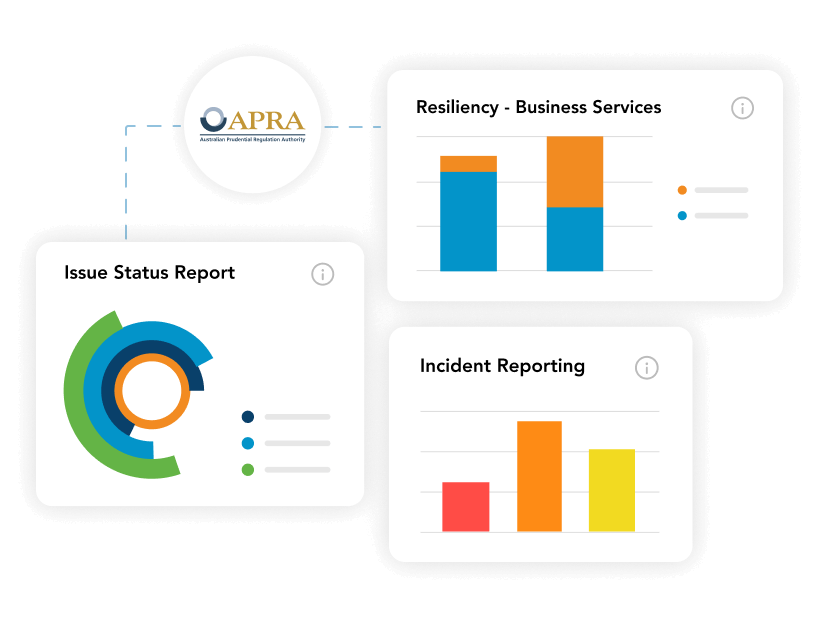

APRA CPS230 (Australian Prudential Regulation Authority)

APRA’s guidelines include requirements for financial institutions to assess and manage risks posed by third-party relationships, ensuring that these partners do not compromise the institution’s stability or compliance with regulatory standards.

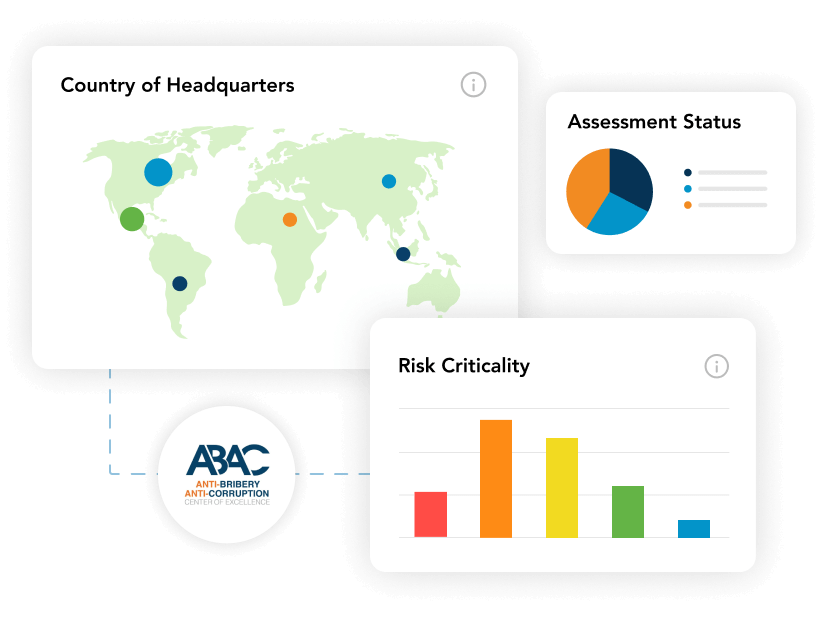

ABAC (Anti-Bribery and Anti-Corruption)

ABAC policies necessitate that organizations globally conduct due diligence on third parties to prevent bribery and corruption. This involves assessing the risk of unethical practices by suppliers, agents, and other partners, and implementing controls to mitigate these risks.

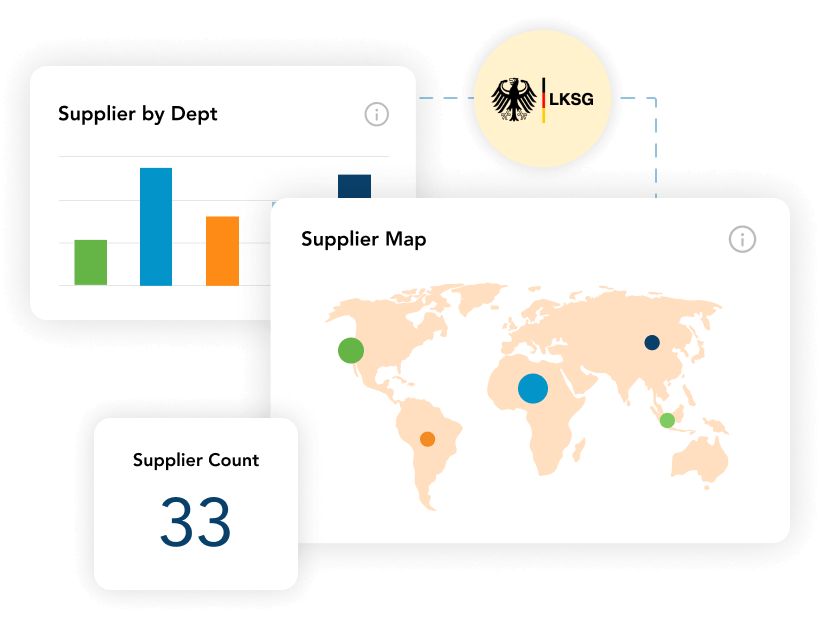

LkSG (Lieferkettensorgfaltspflichtengesetz)

The German Supply Chain Due Diligence Act requires companies to ensure that their entire supply chain, including third-party suppliers, adheres to human rights and environmental standards. This involves assessing and managing risks related to third-party practices and ensuring compliance with the law.

Our Platform Solutions

Automate the complete third-party risk lifecycle, from initial onboarding to ongoing monitoring, with the industry’s most configurable workflow platform.

Learn MoreAccess the industry’s most extensive network of pre-validated vendor assessments and real-time risk intelligence. Our exchange platform enables organizations to make faster, more informed decisions using shared risk data, eliminating redundant assessments and providing deeper insights into potential vulnerabilities across your vendor ecosystem.

Learn MoreNext Steps:

Schedule a ProcessUnity Platform Demo

Our team is here to show you how forward-thinking organizations are elevating

their

Third-Party Risk Management programs and practices to maximize risk

reduction. Start

your journey with ProcessUnity today.